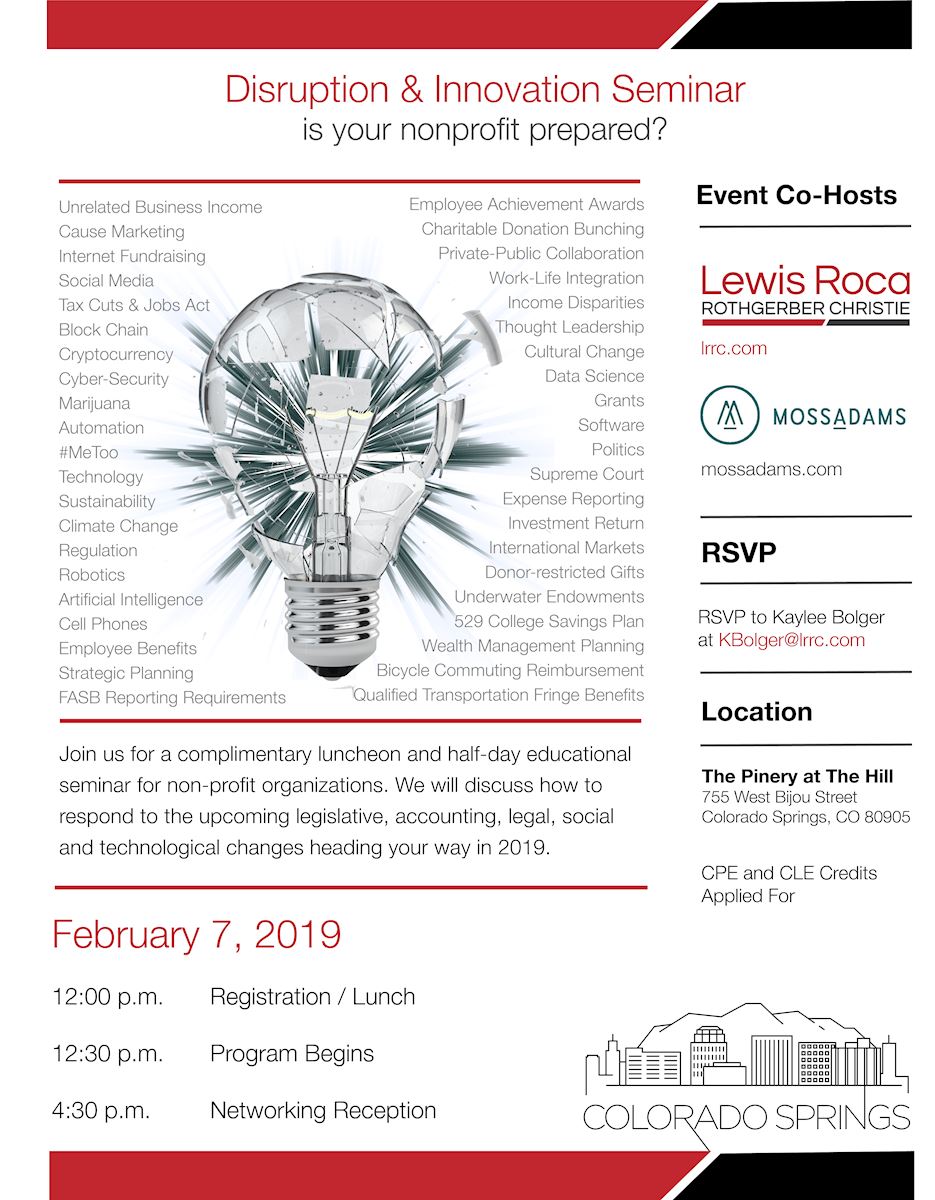

Disruption & Innovation Seminar

Disruption & Innovation Seminar Agenda:

| 12:00 – 12:30 pm | Registration & Lunch |

| 12:30 – 1:00 pm | 2019 Legislative Update: What Non-Profits Should Watch in the Legislative Session and What’s New Since the 2018 Elections Presented by: Dieter Raemdonck |

| 1:00 – 2:05 pm | Key Issues of Tax Reform and Accounting Standards: Operational and Accounting Changes As a Result of the Tax Cuts & Jobs Act and the New FASB Financial Statement Reporting Standards Requirements Presented by Pamela Alexanderson, Chauna King and Corrinne Zajac-Clarkson *CPE credit info below |

| 2:05 – 2:15 pm | Break |

| 2:15 – 3:15 pm | Hot Topics on Income Generation for Non-Profits: Legal Considerations for Non-Profit Fundraising As a Result of Social and Technological Changes Presented by Bobbie Collins and Laura Lo Bianco |

| 3:15 – 4:15 pm | Panel Discussion with Non-Profit Leaders on Innovation and Disruption in the Industry: How (If At All) Non-Profits are Preparing or Responding to Today’s Challenges Presented by Bobbie J. Collins, Bruce A. Geiss, Carrie McKee, and Katherine Brophy |

| 4:15 – 5:30 pm | Cocktail Reception |

Speaker Biographies:

| Laura A. Lo Bianco, Partner, Lewis Roca Rothgerber Christie | |

|

| Professional Experience Laura Lo Bianco brings over 20 years of experience to her role as a partner in the firm’s Business Transactions group. With a focus on corporate law and transactional matters, she advises clients in the areas of business counseling; the formation of organizations, including non-profit, tax-exempt organizations and limited liability companies; mergers and acquisitions; and compliance with the law and best practices. Laura advises various tax-exempt entities, such as private foundations, public charities, schools, support organizations and other entities that are tax-exempt under the Internal Revenue Code. She also guides clients through mergers and acquisitions; the purchase, sale and lease of real property; and with the negotiation of contracts. |

| Bobbie J. Collins, Associate, Lewis Roca Rothgerber Christie | |

| | Professional Experience Bobbie Collins assists clients with a variety of business transactions, with a focus on taxation, real estate and financial services litigation. Her prior New Mexico Real Estate Associate Broker’s License and Master of Laws (LL.M.) in Taxation make her uniquely suited to understand the motivations, regulatory constraints, risk management needs, and advanced financial and tax literacy for her clients. In taxation matters, Bobbie represents nonprofit organizations, including state nonprofit formation, initial exemption determinations, state compliance, joint ventures with for-profit organizations, unrelated business income, and various operations matters. |

| Dieter J. Raemdonck, Associate, Lewis Roca Rothgerber Christie | |

|

| Professional Experience Dieter Raemdonck advises clients on a multitude of government relations, real estate, and gaming matters involving campaign finance and election law; land use and development; and gaming leisure. Providing counsel on government interactions, including both legislative and regulatory matters, Dieter helps his clients understand the government decision-making process and to craft, manage and promote their public policy message. Further, Dieter meets his clients' regulatory law needs by assisting with the development and implementation of strategies to achieve their goals before rulemaking authorities. |

| Pamela Alexanderson, CPA, Director, Moss Adams | |

| | Professional Experience Pam has practiced public accounting since 2008. She serves as a trusted tax advisor for not-for-profit entities, businesses, and individuals with considerable experience working with charitable organizations, foundations, and donors. She helps her clients maintain their tax-exempt status by keeping them informed of changes in the law that may affect their organizations, and helping them manage unique situations that arise during the year. Pam is the leader of tax services for exempt organizations in the Central Region and is a highly rated, frequent speaker on tax-exempt issues. Prior to joining Moss Adams, Pam served as a senior individual contributor at a large Fortune 500 company. |

| Chauna King, CPA, Tax Senior Manager, Moss Adams | |

| | Professional Experience Chauna has practiced tax and accounting since 2012. She has prepared many different types of tax returns including corporations, partnerships, and retirement plans with a focus on not-for-profit organizations and trust and estate returns. Chauna has also taught not-for-profit specific tax trainings at the firm level and at the local United Way’s Center for Nonprofit Excellence. |

| Corrine Zajac-Clarkson, CPA, Senior Manager, Moss Adams | |

| | Professional Experience Corrine has practiced public accounting since 2003. She serves large and complex not-for-profit organizations and foundations with substantial endowment and investment funds. Corrine is a member of the firm’s Government, Not-for-Profit & Regulated Entities Group and has supervised business assurance staff and seniors on various types of assurance engagements. |

| Bruce A. Geiss, CEO, Realty Gift Fund | |

|

| Professional Experience Bruce is a senior real estate executive with 35 years of experience as a builder, developer, broker, investor and consultant. His career of innovative leadership includes an extensive background in strategic planning, financial modeling, regulatory matters, marketing and sales. Bruce has served as Qualifying Broker of Phase One Realty, was a co-founder of American Foundation Realty and Director of Real Estate for Glacier Club, and is a lead consultant to Santa Fe Estates. Bruce is a co-founder of Realty Gift Fund, a specialized nonprofit that exclusively accepts gifts of real estate for the nonprofit world, and serves as its Chief Operating Officer. |

| Carrie McKee, Southern Colorado Regional Director, Rocky Mountain PBS | |

| | Professional Experience With more than 20 years of nonprofit experience in Southern Colorado, Carrie McKee joined the RMPBS team as the Southern Colorado Regional Director in September 2018. Throughout her career, Carrie has kept her focus on leadership, learning and community engagement as she worked toward diverse missions in various sectors of the nonprofit world. Her previous experience includes two and a half years as the President and CEO of Junior Achievement of Southern Colorado, eight years as Executive VP at Pikes Peak United Way, and a decade as Area Director for Southern Colorado Springs Young Life. Carrie moved to Colorado Springs in 1996 after college and began her career in marketing for the United States Olympic Committee. Carrie holds a degree in Speech Communications from the University of North Carolina at Chapel Hill where she also captained the National Championship Women's Basketball Team in 1994. |

| Katherine Brophy, Director of Communications and Marketing, Thomas MacLaren School | |

|

| Professional Experience Katherine Brophy, co-founder and Director of Communications and Marketing for Thomas MacLaren School, received her BA in French and in English Literature from Saint Mary's College (Indiana). Previous to working for MacLaren, she spent almost six years on the Board of Directors. Her four oldest children have graduated from MacLaren and her other two children currently attend the school. She enjoys working alongside the great faculty and staff at MacLaren. |

| *CPE Required Items |

|

2. Recommended CPE credit and Field of Study = Taxes 1.0 credit 3. Delivery Method = Classroom 4. Learning Objectives = Describe recent and new accounting guidance, determine which fringe benefits would result in inclusion in unrelated business income for the organization, describe the changes in reporting on the 990-T form related to the separation of unrelated business income sources by activity. 5. Prerequisite knowledge/advanced preparation = none 6. Course registration requirements/link = email Kaylee at KBolger@LRRC.com 7. Refund/complaint policy = For more information about administrative policies regarding CPE, refunds or complaints, please contact Kendall Re at 503-471-1272 or send her an email at kendall.re@mossadams.com. Official NASBA sponsor statement = Moss Adams is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State Boards of Accountancy have the final authority on the acceptance of individual course for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org. |

.png)